CUHK

News Centre

A Study by CUHK Institute of Future Cities and the Platform Concerning the Subdivided Flats Issue in Hong Kong on Rent-to-Income Ratio of Subdivided Units

The Centre of Land Resource and Housing Policy, Institute of Future Cities (IOFC) at The Chinese University of Hong Kong (CUHK), supported by the Knowledge Transfer Fund at CUHK, has collaborated with the Platform Concerning the Subdivided Flats Issue in Hong Kong to study the actual change in the rent-to-income ratio (RTIR) of subdivided units in Hong Kong. Over the past six months, researchers conducted a professional survey of more than 60 subdivided units through a 100% on-site study, face-to-face interviews and cross-validation with approved building plans. It is found that the RTIR has been increased to 41.1%, with the per capita living area decreased to 47.8 square feet (sf) (which is much lower than the lowest standard of 70sf in public rental housing). If the per capita living area is adjusted to 67.6sf (according to the report by Policy-21 in 2013, commissioned by the government) the RTIR would actually be 72.8%.

Prof. Edward Yiu Chung Yim, Associate Director of IOFC said, ‘these findings reflect that over the past two years, the RTIR has deteriorated much more severely than some superficial indicators show. Basically, the low-income households have to cram into smaller housing units to achieve the affordability level.’

In view of the severe situation, the research team has the following short and medium term proposals:

For the medium-term, it is suggested that the Urban Renewal Authority should develop more public housing. In the short-term, the government should provide transitional housing for households which have been queuing for public rental housing for more than 3 years by mobilizing the vacant units of government quarters, schools, and donated housing units managed by non-governmental organizations (NGOs).

Housing Affordability Index

In general, housing affordability is measured by (1) housing price to income ratio, (2) mortgage payment to income ratio, and (3) rent-to-income ratio. However, the former two indicators are frequently reported by the government and NGOs, though they are related to the affordability of home buying and cannot reflect the rental affordability of low-income households. Unfortunately, RTIR is only reported once every five years by the Census and Statistics Department, which is not good enough for responding to the swift changes in the rental markets.

Furthermore, RTIR is merely reported as the median rent to median household income in the Census, without adjustment for the changes in housing quality. That is why the three consecutive RTIRs were more or less at the same level of 25% (27.3% in 2001, 25.2% in 2006, and 25.7% in 2011), which seems to be quite affordable.

The government actually realizes the RTIR needs a control adjustment for quality change, and they derive internally an indicator which is calculated by multiplying the average housing price (reported by the Rating and Valuation Department) by 39.9 square meters, and then dividing it by the median household income for each month. The indicator has already been increased to 40% in 2015. However, since this calculation is based on a division of an average by a median, and is not based on the exact housing rent to the particular household, the errors would be large and the interpretation of the indicator is difficult to comprehend.

Comparison to the related studies in 2013

Other studies by NGOs on RTIR also do not have a control adjustment for housing quality. For example, the report by Policy-21 in 2013 commissioned by the government reported that RTIR of subdivided units was 29.2%, and the per capita living area was about 67.6 square feet (based on the respondents’ estimations).

All these studies do not consider the fact that when housing rent is unaffordable, households would be forced to live in a poorer or smaller housing unit, so as to make it affordable. In other words, all these RTIRs would be under-estimated when housing rent is increasing faster than household income. Thus, a quality-adjusted RTIR, including size-adjustment, is necessary when measuring housing affordability.

Comparing the results of the two studies, there is only an increase of 29% in the average rent per square foot, which is similar to the increase measured in the Rental index of Class A housing units reported by the Rating and Valuation Department. However, if taking the per capita living area of 2013 into calculation of this study, the RTIR of the subdivided units will escalate to about 72.8%, which is almost a 50% increase in a two-year period.

IOFC is carrying out a quarterly study on subdivided units, besides reporting the actual changes of RTIR regularly and the first rental index for subdivided units will also be released next month.

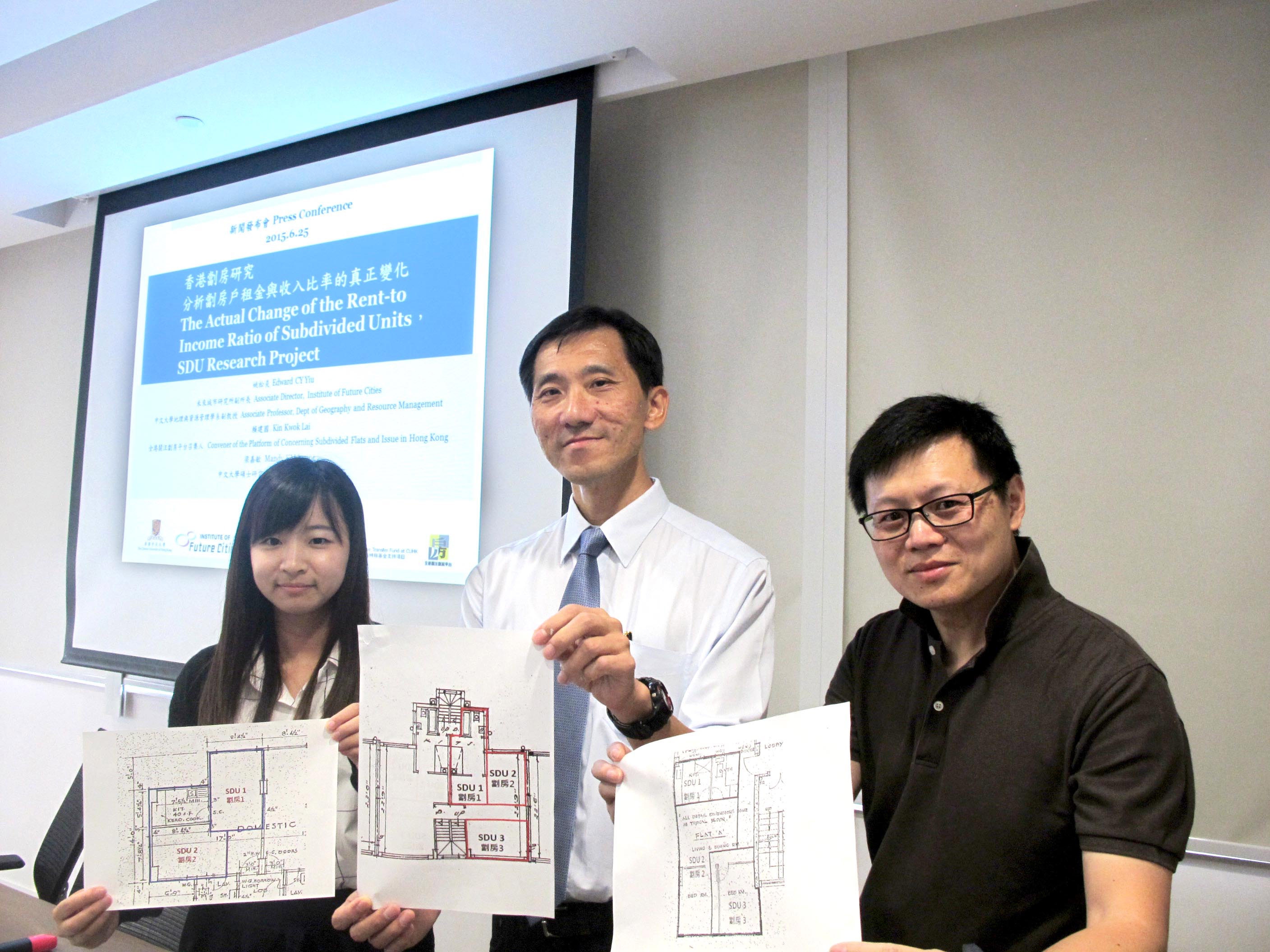

Prof. Edward YIU, Associate Director of the Institute of Future Cities, CUHK (middle), Miss Ka Man LEUNG, MPhil student of the Department of Geography and Resource Management, CUHK (left), and Mr. Kin Kwok LAI, Convener of the Platform Concerning the Subdivided Flats Issue in Hong Kong, release the research results on Subdivided Units.