Events

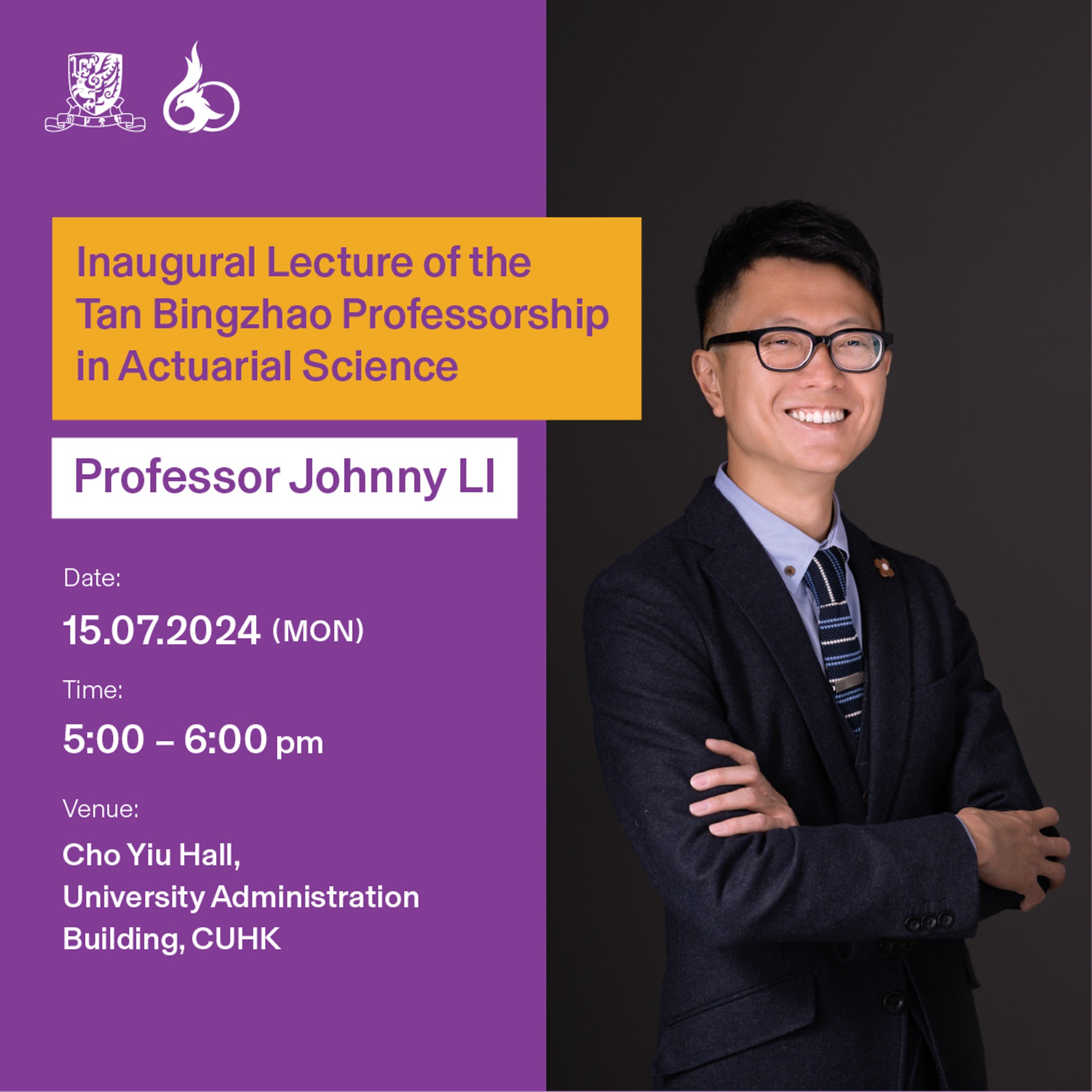

Inaugural Lecture of the Tan Bingzhao Professorship in Actuarial Science by Professor Johnny Li

15 Jul 2024

5:00-6:00pm

Cho Yiu Hall, University Administration Building, The Chinese University of Hong Kong

Professor Johnny Li

Please confirm your attendance by Friday 28 June 2024 via the link below.

We look forward to welcoming you on this special occasion.

4:30pm Guest registration

5:00pm Lecture commences

6:00pm Lecture concludes

Landing Safely in Extended Retirement: An Actuarial Researcher’s Perspective

Retirement marks a transformative stage in life, offering the opportunity to enjoy leisure, pursue passions, and spend quality time with loved ones. However, it also comes with financial risks that everyone must navigate. Among these, the most critical is the risk of outliving financial resources. This risk has grown due to longer life expectancies resulting from healthier lifestyles and improved medical care. To address this, careful retirement planning is essential.

In this talk, I will first provide an overview of several financial products that are designed specifically to solve the problem of length-of-life uncertainty. One such product is advanced-delayed life annuity, which guarantees a reliable stream of cash payments until death in exchange of a lump sum. It functions like an insurance against longevity in that payments do not start until a retiree’s other assets are spent down. Another example is reverse mortgage, through which homeowners can convert their home equity into regular monthly payouts while maintaining residency in their properties for the rest of their lives. Following the overview, I will introduce a life cycle model that informs optimal saving and consumption decisions when access to the mentioned financial products is considered.

Finally, I will discuss the mentioned financial products from the providers’ angle. I will explain the range of risks that are transferred from retired individuals to the product providers, and how product providers may manage such risks with innovative solutions such as longevity risk securitization.