Events

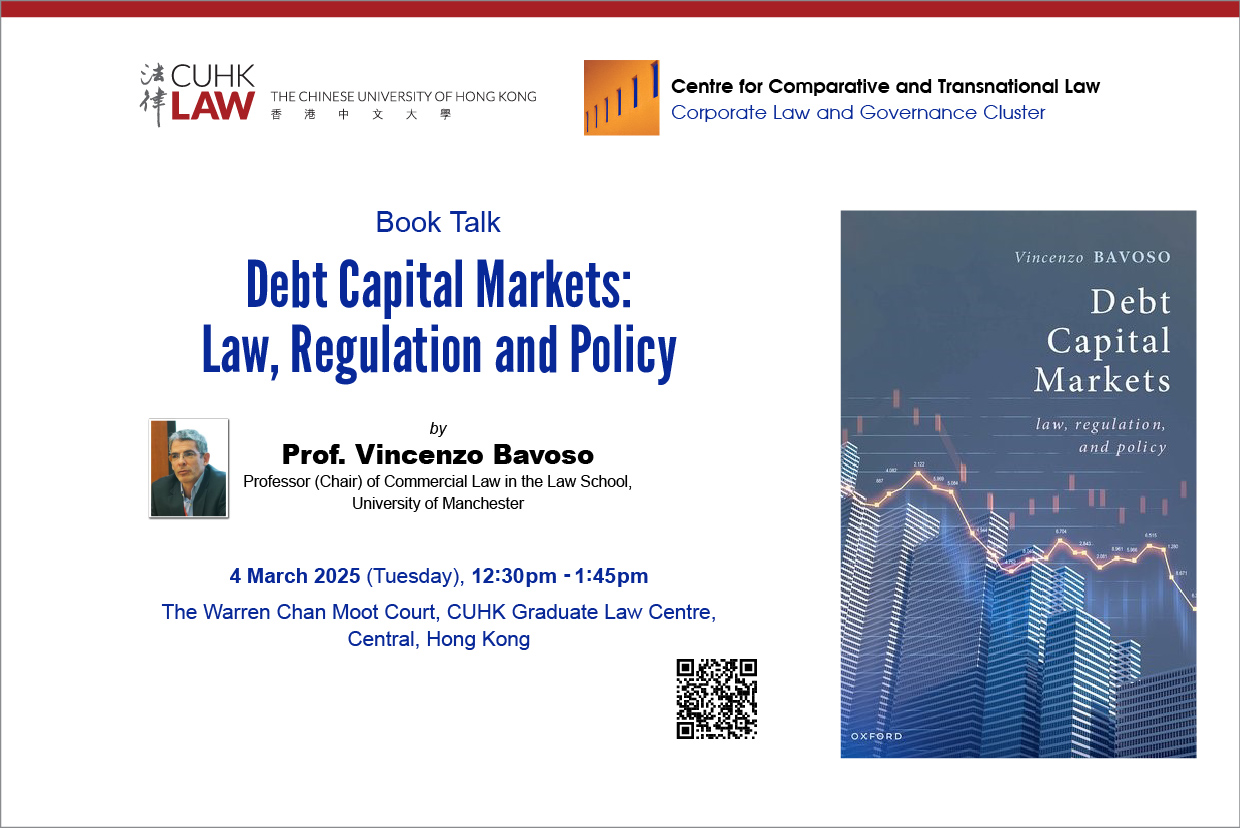

CCTL Corporate Law and Governance Cluster Book Talk – ‘Debt Capital Markets: Law, Regulation and Policy’ by Prof. Vincenzo Bavoso

4 Mar 2025

12:30 pm – 1:45 pm (HKT)

The Warren Chan Moot Court, CUHK Graduate Law Centre, Central, Hong Kong

Prof. Vincenzo Bavoso is a Professor (Chair) of Commercial Law in the Law School, University of Manchester, where he has previously been a lecturer and senior lecturer. Before returning to Manchester, he was a research associate in the Tipping Points project at Durham University. This was a multidisciplinary project funded by the Leverhulme Trust where he focused on the global financial crisis in the banking sector. Before then, he held academic appointments at Kingston University, London, and as teaching assistant at the University of Manchester, where he also completed his PhD. He held visiting appointments at the Institute of Advanced Legal Studies, London; the China-EU School of Law, at the China University of Political Science and Law, Beijing; the National University of Singapore; the Chinese University of Hong Kong; the Singapore Management University. Prior to entering academia he was a legal practitioner, having qualified to the bar in Italy.

His research interests embrace two main strands. First, the broad field of financial regulation and in particular the regulation and practice of capital markets. Secondly, the intersection between corporate law and governance. He has published widely in the above areas. His work on securitisation and capital markets has been cited by the EU Parliament, the Wall Street Journal, Bloomberg (twice) and S&P Global Markets. His works on the EU Capital Markets Union and on the attendant Securitisation Regulation have informed policy-making exercises, among which, Foundation for European Progressive Studies (FEPS), Centre for European Policy Studies (CEPS), European Capital Markets Institute (ECMI), Politico.

He is the director of two LLM courses at Manchester, one focused on the law and practice of securities markets, and another on the regulation of international finance.

At Manchester, Vincenzo has been the co-director of the Manchester Centre for Law and Business, PGR director, and is currently the LLM director. He is also co-editor in chief of Law and Financial Markets Review.

His research can be accessed on his SSRN author page.

https://cloud.itsc.cuhk.edu.hk/webform/view.php?id=13700926

Submission Deadline: 12:30 pm (HKT), 3 March 2025

This monograph deals with the law and regulation of debt capital markets. It explores in particular the role that they have in fuelling episodes of crises and financial instability and the central argument laid out in this book is that instability in financial markets – culminated with the global financial crisis of 2008 and resurfacing with urgency since 2020 – is the result of a process of transformation that started in the 1980s. The analysis in this book charts the evolution of debt capital markets and their growth propelled by the undisputed belief in the validity of neoclassical economics, and attendant assumptions of efficient markets. This orthodoxy in turn informed the changes that shaped, between the 1980s and 1990s, the regulatory edifice of capital markets. This book explains how this process of transformation and liberalisation led to debt capital markets -from bonds to more sophisticated forms of securitised credit- becoming uncontrolled engines of private debt creation, high levels of leverage, and inevitably, financial instability. Ultimately, this book contends that the regulatory reactions engineered after the global financial crisis of 2008 have not gone far enough in re-evaluating those underlying beliefs and assumptions, which in fact remain at the heart of current policies. As a result, debt capital markets remain the main locus of financial instability, as current episodes of turbulence indicate, and overall the financial system remains fragile and exposed to the most severe consequences of shocks.

Language: English