Events

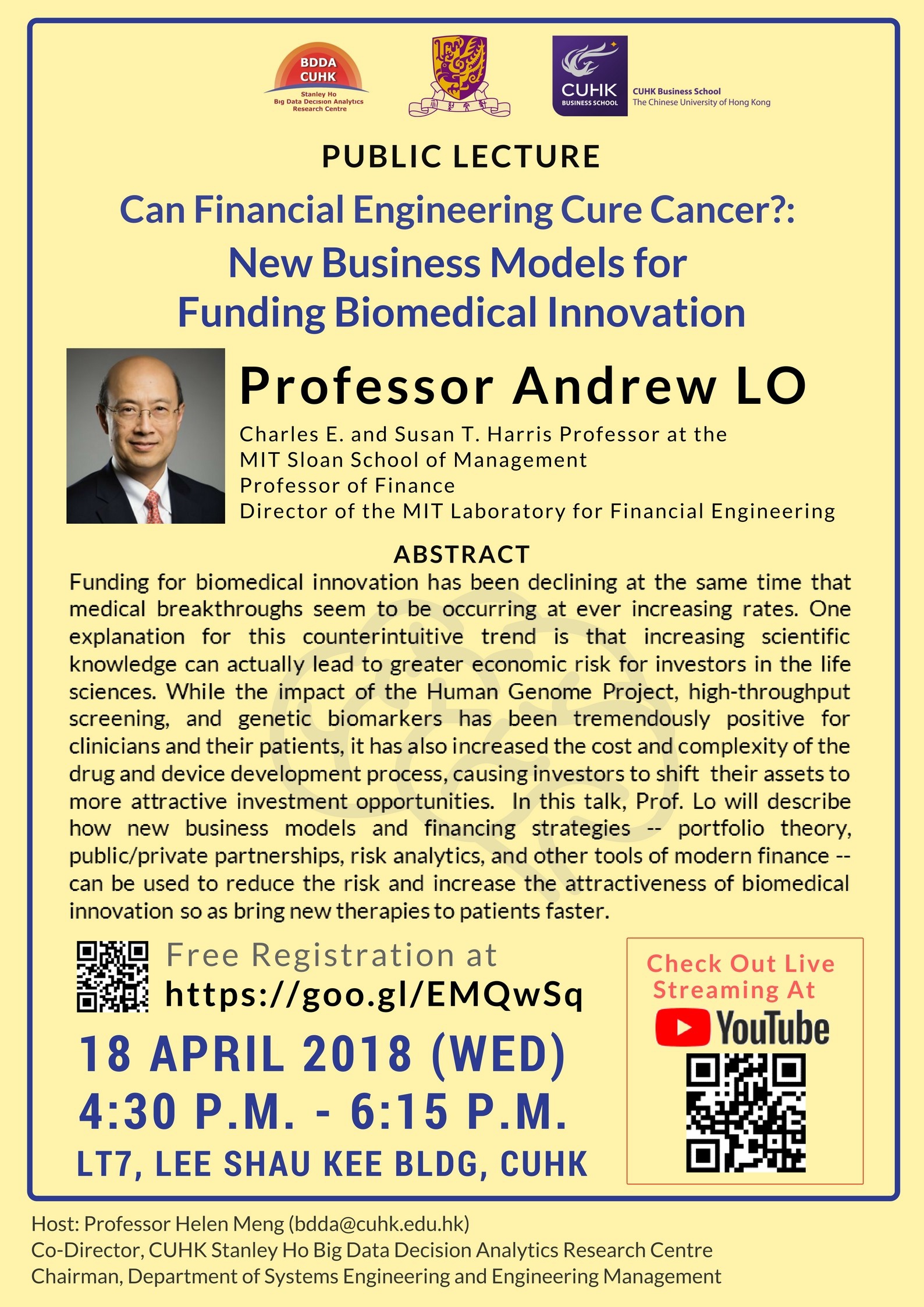

Can Financial Engineering Cure Cancer?: New Business Models for Funding Biomedical Innovation

18 Apr 2018

4:30-6:15 pm

LT7, Lee Shau Kee Building, CUHK

Professor Andrew Lo

Andrew W. Lo is the Charles E. and Susan T. Harris Professor at the MIT Sloan School of Management and director of the MIT Laboratory for Financial Engineering. He received his Ph.D. in economics from Harvard University in 1984. Before joining MIT’s finance faculty in 1988, he taught at the University of Pennsylvania’s Wharton School as the W.P. Carey Assistant Professor of Finance from 1984 to 1987, and as the W.P. Carey Associate Professor of Finance from 1987 to 1988.

He has published numerous articles in finance and economics journals, and has authored several books including Adaptive Markets: Financial Evolution at the Speed of Thought, The Econometrics of Financial Markets, A Non-Random Walk Down Wall Street, Hedge Funds: An Analytic Perspective, and The Evolution of Technical Analysis. He is currently co-editor of the Annual Review of Financial Economics and an associate editor of the Financial Analysts Journal, the Journal of Portfolio Management, and the Journal of Computational Finance.

His awards include the Alfred P. Sloan Foundation Fellowship, the Paul A. Samuelson Award, the American Association for Individual Investors Award, the Graham and Dodd Award, the 2001 IAFE-SunGard Financial Engineer of the Year award, a Guggenheim Fellowship, the CFA Institute’s James R. Vertin Award, the 2010 Harry M. Markowitz Award, and awards for teaching excellence from both Wharton and MIT.

Professor Helen Meng (bdda@cuhk.edu.hk)

Abstract: Funding for biomedical innovation has been declining at the same time that medical breakthroughs seem to be occurring at ever increasing rates. One explanation for this counterintuitive trend is that increasing scientific knowledge can actually lead to greater economic risk for investors in the life sciences. While the impact of the Human Genome Project, high-throughput screening, and genetic biomarkers has been tremendously positive for clinicians and their patients, it has also increased the cost and complexity of the drug and device development process, causing investors to shift their assets to more attractive investment opportunities. In this talk, Prof. Lo will describe how new business models and financing strategies—-portfolio theory, public/private partnerships, risk analytics, and other tools of modern finance—can be used to reduce the risk and increase the attractiveness of biomedical innovation so as bring new therapies to patients faster.