CUHK

News Centre

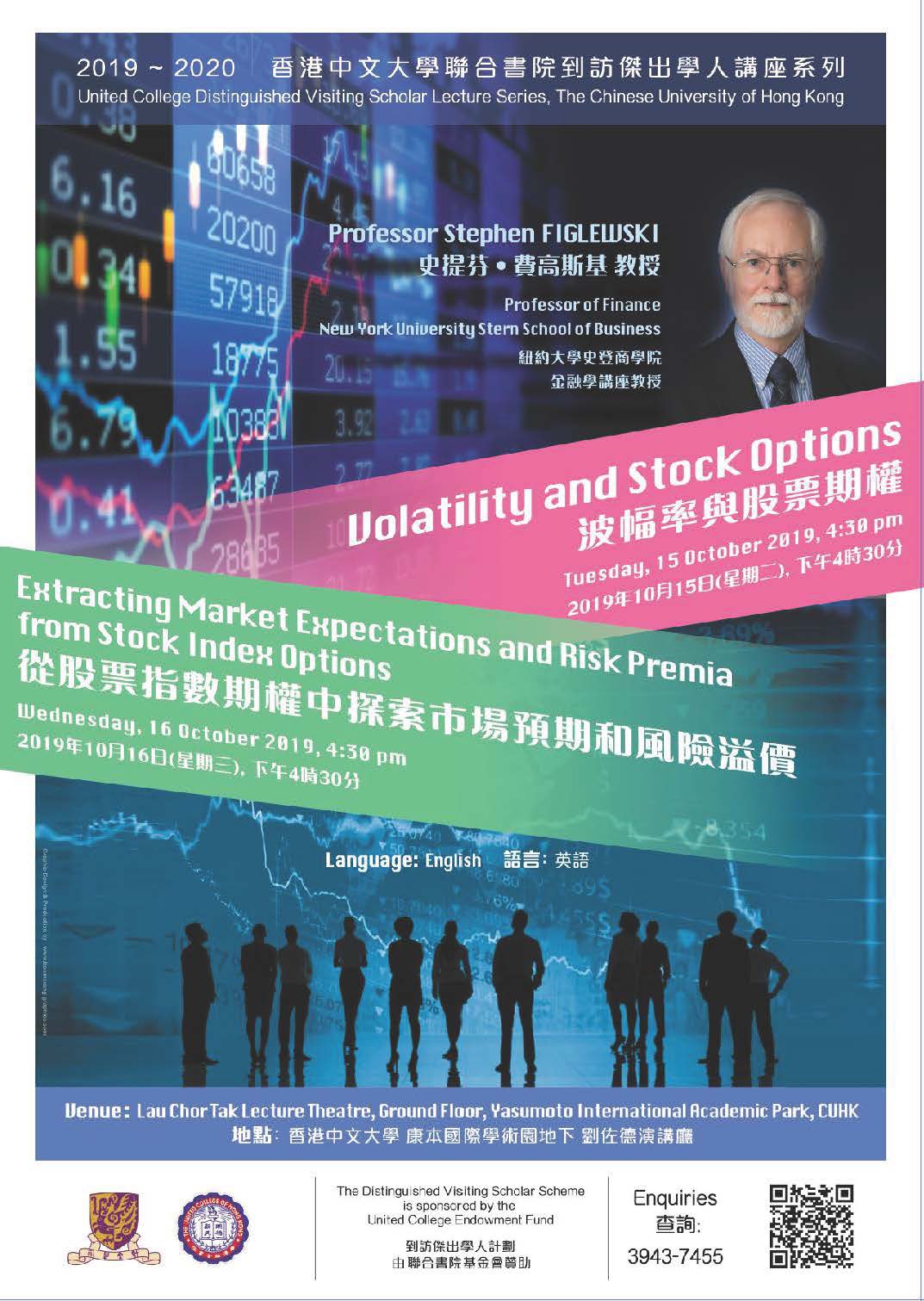

CUHK United College Distinguished Visiting Scholar Professor Stephen Figlewski to Give Talks on Investment Strategies and Stock Index Options

The United College of The Chinese University of Hong Kong (CUHK) has invited Professor Stephen Figlewski, Professor of Finance, New York University (NYU) Stern School of Business, to be the College’s Distinguished Visiting Scholar in 2019-20. Professor Figlewski will visit the College from 13 to 20 October 2019 and deliver lectures on “Volatility and Stock Options” and “Extracting Market Expectations and Risk Premia from Stock Index Options”. The visit of Professor Figlewski is supported by the United College Endowment Fund.

Both lectures will be delivered in English. Members of the public are welcome. Details are as follows.

Lecture 1: Volatility and Stock Options

The Black-Scholes option pricing model introduced in 1973 set off enormous growth and proliferation in derivatives in the decades since then. The original model and those that have built upon it take stock price volatility as an essential input. But while volatility has a very specific meaning in financial modeling, most investors use the term for several different aspects of stock price behaviour, as well as for implied volatility extracted from option market prices. The first objective of the lecture will be to clarify the different meanings of “volatility” both in common language and in option pricing models.

The Volatility Index (VIX) was designed to measure the volatility implied in the market prices for options. At first the VIX was mainly a measure of relative option pricing but in 2004 the Chicago Board Options Exchange began introducing futures and options contracts based on the VIX. These proved immensely popular and many exchanges around the world launched similar indexes, including the HSI Volatility Index (VHSI) in Hong Kong. Hundreds of volatility-based exchange-traded funds and notes (ETFs and ETNs) have also been introduced. But volatility is a very different kind of underlying variable than a stock price and volatility derivatives do not behave like those on financial securities. The second part of the lecture will focus on these differences and their very important effects on investment strategies involving volatility derivatives.

|

Date: |

Tuesday, 15 October 2019 |

|

Time: |

4:30 pm – 6:00 pm |

|

Venue: |

Lau Chor Tak Lecture Theatre, G/F, Yasumoto International Academic Park, CUHK |

Lecture 2: Extracting Market Expectations and Risk Premia from Stock Index Options

An option price reflects the market’s estimate of the underlying stock’s volatility. But options with different strike prices produce different implied volatilities for the same stock, the so-called “volatility smile”. Although the smile means that prices in the options market do not agree with the theory, it is common to try to model the behaviour of the Black-Scholes volatility surface anyway. Alternatively, by using many options with different strikes at the same time, one can extract an entire implied probability distribution over the stock price at option expiration without using a theoretical pricing model. Today’s VIX is based on this model-free methodology. But like parametric pricing models, it treats investors as being identical, which is a big problem because identical investors would never take opposite sides of the same contract. Investors in a real world options market trade with each other because they are different in their beliefs about the future stock price and their willingness to bear risk.

Today there are multiple derivatives, futures, options, and exchange-traded funds, all tied to the same stock market index, such as the S&P 500 and the HSI. Exposure can be long or short, with different degrees of leverage. The implied probability distributions from these multiple markets allow us to explore investor heterogeneity in a way that has not been possible before. The first part of the talk will review what we know about implied volatilities and the volatility surface. The second part will present new results on investor heterogeneity from probability distributions extracted from closely related but quite different equity derivatives.

|

Date: |

Wednesday, 16 October 2019 |

|

Time: |

4:30 pm – 6:00 pm |

|

Venue: |

Lau Chor Tak Lecture Theatre, G/F, Yasumoto International Academic Park, CUHK |

Lecture details: http://www.cuhk.edu.hk/uc/dvs/2019-20

Registration: https://cloud.itsc.cuhk.edu.hk/webform/view.hp?id=6231331

For further information, please contact Mr. George Lam at 3943 7598 or Ms. Amy Yeung at 3943 7455, Dean of Students’ Office, United College, CUHK.

Biography of Professor Stephen Figlewski

Professor Figlewski received his Bachelor of Arts in Economics, summa cum laude, from Princeton University and his Doctor of Philosophy in Economics from the Massachusetts Institute of Technology in 1976. He is the director of the NYU Stern Derivatives Research Project. His primary research interests include derivatives, risk management and financial markets. In addition to his academic and research works at NYU, Professor Figlewski was a Vice-President at the First Boston Corporation, responsible for research on equity derivatives products, and has been a market maker in stock index options at the New York Exchange.

Professor Figlewski has published extensively in academic journals, especially in the area of financial futures and options. A majority of his publications appear in top tier journals, such as the Journal of Finance, the Journal of Financial Economics, and The Review of Financial Studies. He published over 100 papers and his H-index is over 30.